PMEGP stands for Prime Minister Employment Generation Program. The scheme is under the purview of the Khadi and Village Industries Commission at the level of the overall country. The scheme covers a cost of INR 25 lakhs if it is a manufacturing sector and INR 10 lakhs if it is a service sector. The categories of beneficiaries who are covered under the scheme includes the following:

In case of urban areas

- If you belong to the general category, your own contribution to the cost of the project should be somewhere around 10% and you shall get a subsidy of 15%

- If you belong to the Special category such as scheduled caste and tribe, ex-servicemen, amongst others, your own contribution to the cost of the project should be somewhere around 5% and you shall get a subsidy of 25%

In case of rural areas

- If you belong to the general category, your own contribution to the cost of the project should be somewhere around 10% and you shall get a subsidy of 25%

- If you belong to the Special category such as scheduled caste and tribe, ex-servicemen, amongst others, your own contribution to the cost of the project should be somewhere around 5% and you shall get a subsidy of 35%

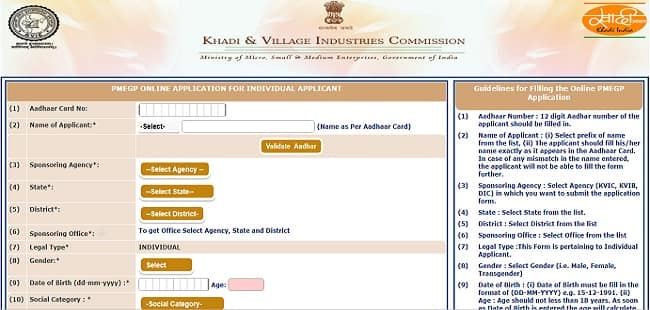

Online Application Form

The online application form for the PMEGP loan is readily available. The details which needs to be filled in this particular form includes the following:

Aadhaar card Number, name of the applicant, sponsoring agency and the state, gender, date of birth, social category, communication, email address, unit address, the block in which you as an individual are residing, the details of the bank with which you normally transact, the name of the bank, the address IFSC code, etc. besides, you also need to fill details such as the EDP training date, the office which is sponsoring your loan etc.

After having filled all these details, you are one step ahead of getting your loan under the coveted program.

The following is the official website for filling the online application for the PMEGP Loan

https://www.kviconline.gov.in/pmegpeportal/jsp/pmegponline.jsp

Eligibility Criteria

Not everyone is eligible to apply for a loan under the PMEGP program. The government has established certain criterion under which a person can apply and get benefits of the scheme in question. The eligibility criteria for the PMEGP loan is as under:

- To begin with, you have to be an individual who is at least 18 years of age.

- The good part is that you need not fall within a defined income group in order to take assistance of the scheme

- In certain conditions, you should be at least VIII standard pass. The condition is required in case of the following:

- If you want the loan for setting up a project which costs above rupees 5 lakh in the business or the service sector

- If you want the loan for setting up a project which costs above rupees 10 lakh in the manufacturing sector

- In order to take benefits of the scheme, you have to select a project that falls under the criteria which can get the benefit

- If you are an institution that is already taking advantage of the government subsidy under any other mentioned programs of the government, you shall not be eligible to get loan under this particular scheme

- When you take the loan, the cost of the project to be evaluated should be that it involves not only the capital expenditure but also your day to day working capital for at least one cycle

- In order to avail the benefits under this scheme of the government, you have to ensure that the loan is being taken for use in a project that is new and not an existing one

For more information, visit the following url

https://msme.gov.in/eligibility-criteria-pmegp-scheme

Documents Required

Let us now look into the list of documents that are required for availing the loan under the PMEGP program.

- Caste certificate or a similar certificate to that effect from a competent and authorized authority in order to provide evidence that the said individual is eligible for loan under this scheme

- Individuals should also provide a proof that they are eligible for the subsidy that they have requested for

- If you are a society that has applied for the loan, then you also need a bye laws certified copy

- Another important document is the one that shows the total expenditure of the project-the whole of capital expenditure as well as the working capital for one particular year. The following things need to be kept in mind while you are computing your project cost:

- The cost of the land where the project is being done should not be taken into account

- The individual is free to include the cost of leasing and cost of rent in case of a property not owned by them. However, you have to keep in mind that the period of such rent or lease should not exceed a total of 3 years

Thus, to conclude you can take the benefits of the PMEGP programme and make the most out of it if you fit the eligibility criteria.

Santosh Kumar, the author behind IndiasStuffs.com, is passionate about sharing valuable insights on a variety of topics, including lifestyle, technology, and Indian culture.